Oil and gas companies operate in dynamic and complex environments, constantly facing challenges, particularly in terms of supply and demand. Currently, with historic price reductions, procurement has become a key factor in the success of this industry.

Procurement costs are a significant part of the total cost for oil and gas projects. Choosing the right supplier can have a profound impact on the success or failure of a project. Therefore, selecting a high-quality supplier that can provide cost-effective equipment and services is crucial. This supplier must meet the specified requirements and not disrupt the project schedule.

In this context, focusing on the quality and reliability of suppliers, especially in challenging market conditions, can help reduce costs and improve project efficiency. The image below illustrates the equipment on an oil platform, highlighting the importance of proper equipment procurement in this industry.

1. Categorized Method

The categorized method is one of the simplest and most efficient ways to evaluate suppliers. In this method, a list of key performance variables or factors is defined. Buyers assign scores to each evaluation feature in a categorized manner, for example, using terms like “Good,” “Neutral,” and “Weak.”

These rankings are made based on agreements and opinions from representatives across various departments, including procurement, supply, and production. Ultimately, the supplier that receives the highest score in this evaluation is recognized as the best option. This method helps companies make better decisions when selecting suppliers and improves the overall performance of projects.

2. Weighted Point Method

The weighted point method is one of the most widely used and effective methods for evaluating suppliers. In this method, various features important to customers are weighted based on their level of importance.

In the first step, evaluators score each supplier’s performance based on each feature. These scores are then multiplied by the weight assigned to each feature. Finally, the weighted scores are aggregated to determine the final performance rank of each supplier.

The supplier with the highest weighted score is considered the best option. This method enables companies to make more informed decisions and optimize overall project performance.

3. Cost Ratio Method

The cost ratio method is a comprehensive approach for evaluating suppliers, which considers the total cost of each purchase, including the selling price and the buyer’s internal operational costs. These costs are linked to various factors such as quality, delivery, and related services, and are calculated as the total purchase price for the company.

In this method, each internal operational cost is converted into a ratio, which represents a percentage of the total purchase value. This overall cost ratio is then applied to the supplier’s proposed unit price to determine the adjusted net cost.

The supplier with the lowest adjusted net cost is recognized as the preferred supplier. This method helps companies make better decisions while optimizing costs.

4. Dimensional Analysis Model

The dimensional analysis model is an advanced technique for evaluating suppliers, designed to overcome the limitations found in other methods. This model combines several criteria with their relative importance into a single framework for evaluating each supplier.

In this method, the supplier’s performance index is calculated based on a comparison of its performance against predetermined standards for a range of criteria and their relative importance. Each supplier is evaluated based on this performance index. Criteria can have positive or negative weights; for instance, quality may have a positive weight, while price might have a negative weight.

As a result, the dimensional analysis model enables companies to evaluate suppliers based on a standardized set of criteria and make better decisions in selecting suppliers. This method improves the accuracy of evaluations and enhances transparency in the supplier selection process.

5. Analytic Hierarchy Process (AHP)

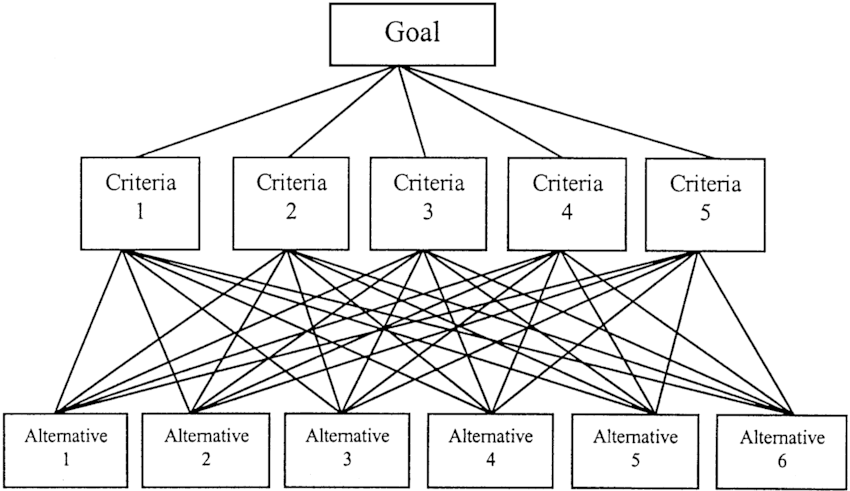

The Analytic Hierarchy Process (AHP) is a powerful and flexible tool for solving complex, multi-criteria problems. AHP breaks down a complex issue into hierarchical levels, where the top level represents the goal, the middle levels consist of criteria and sub-criteria, and the lower level represents the options or alternatives.

In this process, the relative importance of each criterion determines which criteria have the highest priority. To determine these priorities, interviews with experts are conducted to make pairwise comparisons between homogenous criteria. After a series of pairwise comparisons, the weight of each criterion is determined, and these weights can be used to build a supplier evaluation system.

AHP allows companies to make better decisions when selecting suppliers and improves the evaluation process. Figure 1 illustrates the overall structure of AHP and shows how criteria and options are organized.

Supplier Selection Process

Experts believe that there is no universal or single method for evaluating and selecting suppliers. Therefore, organizations use diverse approaches tailored to their specific needs. The primary goal of the supplier evaluation and selection process is to minimize the risks associated with procurement and maximize the overall value for the buyer.

This process includes identifying key criteria, evaluating supplier performance based on these criteria, and selecting the best options based on the analyses conducted. By adopting a systematic and comprehensive approach, organizations can make better supplier selection decisions and improve the overall performance of their supply chain.

Identifying Needs: Precisely determining the business requirements for selecting the right supplier.

Defining Evaluation Criteria: Specifying the criteria that are important for evaluating suppliers, such as quality, price, delivery time, and after-sales service.

Supplier Search: Identifying and gathering information about potential suppliers who can meet the organization’s needs.

Evaluation and Comparison: Reviewing and assessing suppliers based on the defined criteria and comparing them with each other.

Supplier Selection: Choosing the supplier that best matches the organization’s needs and criteria.

Negotiation and Contract: Finalizing negotiations and drafting a contract with the selected supplier.

Ongoing Monitoring and Evaluation: Monitoring and evaluating the supplier’s performance over time to ensure continued alignment with the organization’s requirements.

These steps help businesses make better decisions when selecting suppliers and optimize their supply chain performance.

Stage 1: Identifying Key Supplier Evaluation Categories

One of the first steps in preparing a supplier survey is determining the performance categories that need to be evaluated. The main criteria include cost/price, quality, and delivery time. However, for critical items requiring deeper analysis of a supplier’s capabilities, a more thorough evaluation study is necessary.

At this stage, organizations need to identify and define the key categories, which can include:

Cost/Price: Assessing proposed prices and related costs for supplying goods or services.

Quality: Evaluating the quality standards of the products or services provided by the supplier.

Delivery Time: Assessing the supplier’s ability to deliver goods and services on time.

After-Sales Service: Evaluating the quality of support services and after-sales assistance from the supplier.

Sustainability and Corporate Responsibility: Reviewing the supplier’s commitment to sustainability and corporate responsibility principles.

By identifying these categories, organizations can more effectively evaluate suppliers and make better decisions when selecting them.

Stage 2: Weighting Each Evaluation Category

At this stage, each of the performance categories is assigned a weight that represents its relative importance in the evaluation process. The total of these weights should sum to 1.0.

One key feature of effective evaluation is its flexibility. Management can achieve this flexibility by assigning different weights to categories or adding and removing performance categories as needed.

For example:

Critical Categories: May receive a higher weight due to their greater impact on the overall performance of the organization.

Secondary Categories: May have a lower weight but are still important in the overall supplier evaluation.

This approach enables organizations to tailor the evaluation process to their specific needs and priorities, resulting in better decisions when selecting suppliers.

Stage 3: Identifying and Weighting Subcategories

At this stage, it’s necessary to identify subcategories within each broader performance category, if applicable. These subcategories may highlight specific aspects of supplier performance and help with a more detailed evaluation.

The sum of the weights assigned to the subcategories should equal the overall weight of the corresponding performance category. This ensures that each subcategory represents a portion of the overall importance of its category.

For example:

If the performance category “Quality” has a weight of 0.4, the sum of the weights for its subcategories (such as “Raw Material Quality,” “Quality Control,” and “Complaint Response”) should equal 0.4.

This process helps organizations conduct a more precise evaluation of suppliers and ensure that all crucial performance aspects are taken into account.

Stage 4: Defining the Scoring System for Categories and Subcategories

At this stage, creating a clear and accurate scoring system is essential. This system should consider criteria that may inherently be subjective and provide a quantitative scale to measure supplier performance.

Effective scoring criteria will ensure that all evaluators can interpret and score the performance categories consistently. To achieve this, it’s necessary to:

Define the Criteria Clearly: Each criterion should be clearly defined to ensure that all evaluators have the same understanding of it.

Develop a Scoring Scale: A quantitative scale (e.g., from 1 to 5 or 1 to 10) should be created, allowing evaluators to easily measure and compare supplier performance.

Train Evaluators: Hold training sessions for evaluators to ensure they correctly understand the criteria and scoring system.

By implementing a comprehensive and transparent scoring system, organizations can perform more accurate evaluations of suppliers and make better decisions in the selection process.

Stage 5: Direct Supplier Evaluation

In this stage, buyers can objectively compare the scores of different suppliers competing for a purchase contract. This comparison allows them to choose one supplier over another based on the evaluation scores.

For an effective evaluation, buyers must first establish minimum acceptable performance requirements that suppliers must meet before they can be added to the supplier base. These requirements could include:

Product Quality: The supplier must meet certain quality standards.

Price: The supplier must offer competitive and reasonable prices.

Delivery Time: The supplier must be able to deliver goods or services on specified timelines.

After-Sales Service: The supplier must provide adequate support services.

By directly evaluating suppliers based on these criteria and requirements, buyers can ensure that selected suppliers not only meet their needs but can also act as reliable partners in the supply chain.

Stage 6: Review Evaluation Results and Make Selection Decision

In this stage, the initial output of the evaluations is presented as a recommendation for accepting or rejecting a supplier for a business. The buyer may evaluate several suppliers competing for the contract in question.

The primary goal of this evaluation is to determine the eligibility of potential suppliers for current or upcoming purchase contracts. To achieve this, the following steps should be followed:

Review the Evaluation Results: The evaluation scores and analyses performed on the suppliers should be carefully reviewed to highlight each supplier’s strengths and weaknesses.

Compare Suppliers: Suppliers should be compared based on the evaluation results and predetermined criteria to identify the best options.

Formulate Recommendations: Based on the results and comparisons, specific recommendations for accepting or rejecting suppliers will be provided.

Make the Final Decision: Considering the recommendations and the business’s specific needs, the buyer should make the final decision about supplier selection.

This process helps buyers identify suitable suppliers and ensure that their selections best meet business requirements.

Stage 7: Ongoing Performance Review

After the buyer has chosen a supplier, it is essential that the supplier continuously maintains their performance according to the buyer’s needs and expectations. This stage involves monitoring the supplier’s performance from the initial evaluation and selection until continuous improvements in the products and services provided are achieved.

To conduct continuous reviews, the following steps should be followed:

Define Performance Metrics: Specific metrics for ongoing supplier performance evaluation should be established. These metrics could include product quality, delivery time, price, and after-sales service.

Collect Data: Regular data on the supplier’s performance should be collected and analyzed to identify strengths and weaknesses.

Provide Continuous Feedback: Regular feedback should be provided to the supplier regarding their performance, especially in areas needing improvement.

Improvement Planning: If weaknesses are identified, specific improvement plans should be developed to help the supplier enhance performance.

Periodic Review: Periodic meetings should be held to review the supplier’s performance and ensure alignment with business goals.

This ongoing review process helps ensure that suppliers consistently meet expectations and can continue to contribute to business success.

Conclusion

Selecting and managing suppliers is a critical process that plays a crucial role in the success of oil and gas projects. By applying the right evaluation and selection methods, companies can make informed decisions, reduce risks, and ensure high-quality products and services. These methods not only help optimize procurement costs but also contribute to long-term project success and operational efficiency.